The 5 Best Free Identity Theft Protection in 2024

Identity theft is a growing concern in our increasingly digital world, where sensitive information is often just a click away from falling into the wrong hands. Many companies offer solid protection plans, but there are also effective steps you can take on your own to safeguard your identity without spending a dime, such as using the best free identity theft protection.

Freezing your credit with the top three credit bureaus is one effective way to prevent identity theft, and it doesn’t take long. You can always “thaw” your credit later if the time comes to apply for a mortgage or a loan. Identitytheft.gov is the federal government’s resource for identity theft victims and can help you figure out an identity recovery plan.

The top three credit bureaus — Experian, Equifax and TransUnion — offer free trials and resources for credit checks. You have to sign up for TransUnion to view your credit score, but Experian and Equifax both have free credit check services. Additionally, we have an article that outlines 99 free privacy tools.

Taking steps to protect your identity can be an overwhelming process. If you don’t want to go it alone, there are several good identity theft protection products you can use for free. In this article, we will explore some of the best free services available and help you make informed choices about how to protect yourself online. Read on to learn about our top picks.

- Comprehend the essential role a VPN plays in safeguarding your digital life

- Gain a deep understanding of how VPNs function under the hood

- Develop the ability to distinguish fact from fiction in VPN promotions

What Is Identity Theft Protection?

Personal data is increasingly digitized and the risk of identity theft has grown, leading to more services aimed at safeguarding your identity. These services typically monitor financial accounts, credit reports and personal data for signs of suspicious activity, such as unauthorized transactions, accounts opened in your name or your information appearing on the dark web.

Though you can perform these actions yourself for free, an identity theft protection service will do it regularly. The goal is to catch fraudulent activity early so you can take swift action to minimize damage. Some services offer basic monitoring, while others offer broader protection, including monitoring of medical records and social media accounts.

Why Is It Important to Have Identity Theft Protection?

Identity theft protection software is essential because it actively monitors your personal information for any suspicious activity in a way that would be very difficult to do on your own. It provides an early warning system against potential threats, such as unauthorized access to your financial accounts, social security number or other sensitive data.

Importantly, identity theft protection often includes recovery services, which are crucial in the event of an identity breach. These services help you navigate the complex process of disputing fraudulent charges and closing affected accounts, and they even offer insurance to cover potential losses. This saves time and minimizes the long-term impact on your financial health.

Of course, prevention is always the best medicine. Check out our article on how to prevent identity theft.

How to Get Free Identity Theft Protection

There are several ways to monitor your credit and stay alerted to potential threats for free, but they all involve doing much of the legwork yourself. The appeal of paid products in this industry isn’t that they perform tasks that you can’t do, but rather that they take care of the tedious work you don’t want to do. Below are some effective methods to safeguard your identity for free.

- Use free credit monitoring services: Many financial institutions and credit bureaus offer free credit monitoring tools that alert you to changes in your credit report.

- Sign up for free trials: Some identity theft protection companies provide free trials of their services, so you can temporarily benefit from their features.

- Leverage credit card benefits: Some credit cards come with built-in identity theft protection features, including monitoring and fraud alerts.

- Use government resources: The Federal Trade Commission (FTC) offers resources and guidelines on how to protect your identity and recover from identity theft.

- Monitor your financial statements: Regularly review your bank and credit card statements for unauthorized transactions, which can help you catch identity theft early.

How to Choose the Best Identity Theft Protection for Free

Since identity theft can have severe financial and personal repercussions, it is necessary to select a service that monitors, alerts and assists with recovery. Only a few services include financial coverage for free. A good customer reputation is also important when it comes to protecting your identity. Below, we cover the main criteria to consider.

- Monitoring capabilities: Monitoring helps detect suspicious activity early by keeping an eye on credit reports, bank accounts and personal information.

- Alert system: This ensures you are promptly notified of any threats or breaches, allowing you to take immediate action if necessary.

- Recovery assistance: Recovery assistance supports you while navigating the aftermath of identity theft, including helping with paperwork and contacting the necessary authorities.

- Insurance coverage: Insurance can help cover costs associated with identity theft, offering an additional layer of financial protection.

- Positive user reviews: Evaluating user reviews and the service’s reputation allows you to see what others have highlighted as its strengths and weaknesses.

The 5 Best Free Identity Theft Protection Service Options

AAA is our top pick of the identity theft protection companies that offer free services, even though it is free only for AAA members. It covers only the basics, but does so without any hidden fees or gimmicks. It offers credit monitoring through Experian, a free credit report, fraud resolution support and $10,000 in identity theft insurance.

1. AAA ProtectMyID Essential — Best Free Identity Theft Protection Overall

If you already have AAA, its identity theft protection service is a great deal.

More details about AAA ProtectMyID Essential:

Pros:

- Trustworthy

- Free credit monitoring

- $10,000 identity theft coverage

Cons:

- Limited free services

- Free only for AAA members

AAA ProtectMyID is a solid entry-level identity theft protection service that’s perfect for AAA members who want basic coverage without paying extra. As part of the Essential plan, AAA members receive credit monitoring through Experian. Coverage includes a complimentary credit report upon enrollment and alerts about any suspicious activity in credit reports.

The reason AAA made it to the top of the list is because of the level of trustworthiness in business that it has maintained for more than 100 years (though its identity theft protection products are newer). The free service lacks some of the advanced features of the paid plans, like tri-bureau credit monitoring, but it does offer $10,000 in identity theft insurance — a rarity in a free service.

AAA ProtectMyID Essential Hands-On Testing

ProtectMyID is tailored for users who want basic identity theft protection without complications or gimmicks. The interface is easy to navigate, with credit alerts and updates prominently displayed on the dashboard. Alerts are sent out within minutes of any changes to your credit report, but there is no dark web monitoring or multi-bureau credit tracking.

2. Experian — Best Single-Bureau Identity Protection

Experian is one of the three major credit bureaus, and it offers free credit checks.

More details about Experian:

Pros:

- Reliable

- Easy to use

- Completely free options

Cons:

- Limited free services

- Limited free trial of paid plans

- Free plan limited to Experian credit checks

Experian IdentityWorks offers three plans: Basic, Premium and Family. The free Basic plan primarily focuses on monitoring your Experian credit report and provides tools like dark web surveillance and a personal privacy scan. It lacks insurance coverage, which is included in the Premium and Family plans.

The paid plans offer monitoring across all three major credit bureaus (Experian, TransUnion and Equifax), advanced identity theft monitoring that alerts you if there is any suspicious activity in your name and up to $1 million in identity theft insurance. The Family plan is a good option if you need to protect multiple people, as it provides coverage for up to two adults and 10 children.

Experian Hands-On Testing

The easily navigable website makes using Experian straightforward, but there are a few factors to be aware of. The paid plans include a seven-day free trial, but it may take up to four days for Experian to begin monitoring Equifax and TransUnion reports. On the plus side, features like real-time credit inquiry alerts and lost wallet assistance are intuitive and easy to use.

Experian has a score of 1.07 with the BBB, with most complaints being about poor customer service and low credit ratings. ItsTrustpilot score is four out of five stars, which is impressive given there are more than 69,000 reviews of the product. Many people have noted that Experian’s “boost” feature has worked well to improve users’ credit scores.

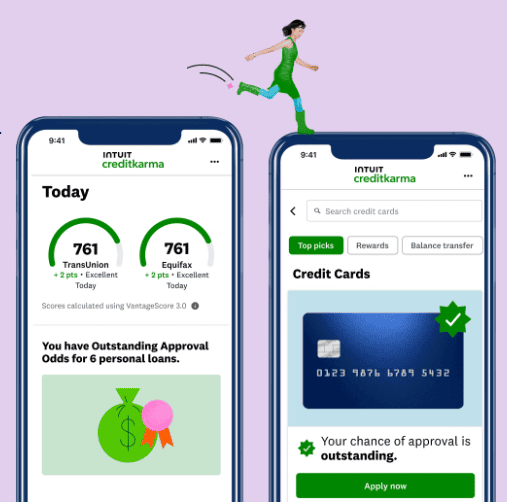

3. Credit Karma — Best Free Identity Theft Protection for Keeping Track of Your Credit Score

Credit Karma has useful financial resources to help improve your credit score

More details about Credit Karma:

Pros:

- Credit building tool

- Free TransUnion credit check

Cons:

- No upgrade options

- No identity theft coverage

Credit Karma is a widely-used, free financial tool that allows users to monitor their credit scores from Equifax and TransUnion. While it doesn’t offer dedicated identity theft protection, it does help you keep track of your credit that can help detect identity theft. Credit Karma offers useful financial resources like credit calculators, credit simulators, and loan recommendations based on users current financial status.

These features help users make informed decisions about credit cards, loans, and even unclaimed money. While these tools are useful, there are some drawbacks to the service. For example, many users have reported discrepancies between the credit scores shown on the platform and those provided by lenders.

Credit Karma Hands-On Testing

Credit Karma’s credit monitoring is straightforward and accessible, but many users have complained about the constant promotion of financial products on the site. That said, the site must make money somehow, and two-bureau credit reports are uncommon in free credit monitoring. This could be a good service to use alongside other financial management apps.

4. Aura — Best Identity Theft Protection With an Extended MBG

Aura lets you use the full product for 60 days. If you don’t like it, you can request a refund.

More details about Aura:

- Pricing: $12 per month

- Website: aura.com

Pros:

- 60-day money-back guarantee

- Uses all three major credit bureaus

- $1 million in identity theft insurance

Cons:

- No free services

- Expensive paid plans

- Customers have reported issues with canceling

Aura is not free, but at 60 days, its money-back guarantee is longer than most. Its identity theft protection services offer credit monitoring across all three major credit bureaus, so you’ll always know what’s going on with your credit score. The service also provides real-time alerts for suspicious activity. Aura’s Family plan covers up to five adults and unlimited children.

Aura also offers extensive recovery assistance with its white-glove fraud remediation service. This feature guides you step by step through the recovery process if your identity is stolen. Aura also includes a substantial insurance policy, with up to $1 million in coverage for identity theft-related costs. It also offers a VPN, antivirus protection and anti-spam call blocking.

Aura Hands-On Testing

Aura has a clean interface and straightforward navigation, so it’s easy to access features like credit monitoring, the password manager, the AI privacy assistant and fraud alerts. Setting up the Family plan is easy and lets you add up to five adults and unlimited children with no hassle. However, some users have reported that the frequency of real-time alerts is overwhelming.

Aura’s Better Business Bureau score is an abysmal 1.16 out of five stars, with the majority of complaints being about poor customer service and trouble canceling a subscription. Its Trustpilot score is much better, at 4.6 out of five stars, with users commenting on the excellent customer service and their many good experiences with the company.

5. EverSafe — Best Identity Theft Protection for Seniors

Seniors can be particularly vulnerable to identity theft, which EverSafe

addresses with tools specifically for this market.

More details about EverSafe:

Pros:

- A+ BBB rating

- 30-day free trial

- Has a “caregivers” tool

Cons:

- No free services

- Expensive paid plans

- Single bureau credit report with most plans

EverSafe is designed with a focus on seniors and families. It offers a 20% discount for anyone over 60. Like most identity theft protection companies, it will keep track of your bank accounts, credit cards and credit reports, and alert you to any unusual activity. However, credit reports are only available on the Plus and Gold plans.

All plans include a “caregiver” tool that allows designated trusted advocates in the family to keep an eye on the accounts of at-risk adults, with read-only access to account activity.

The Gold plan includes identity theft insurance, dark web monitoring and tri-bureau credit reports, whereas the Plus plan includes only single-bureau monitoring. The Plus and Gold plans both include elder fraud monitoring and fraud remediation support. The Essentials plan is basic, with no monitoring included. All plans include 24/7 customer support and a 30-day free trial.

EverSafe Hands-On Testing

Using EverSafe is straightforward. The setup process is smooth, with an intuitive interface that guides you through linking your financial accounts and setting up alerts.

However, it does have some quirks. Though the dashboard is designed for simplicity, it can be difficult to locate certain features like support, which are more prominently displayed with other services. For more on this product, read our full EverSafe review.

Final Thoughts

Identity theft protection is more important today than ever. We’ve highlighted the best free identity theft options available, including AAA ProtectMyID Essential. This service is trustworthy and offers $10,000 in identity theft insurance, making it our top pick.

Have you tried any of these products? Which features are most important to you when choosing identity protection? Do you think paying for identity theft protection is worth it? Let us know in the comments below — we would love to hear from you. Thank you for reading!

FAQ: Free ID Theft Protection

AAA ProtectMyID Essential is entirely free and includes $10,000 in identity theft insurance.

There are plenty of free alternatives to Lifelock. AAA ProtectMyID is one, and Experian is another. You can also manually carry out your own credit check and identity theft remediation by following the guidelines on the FTC website.

We chose AAA ProtectMyID Essential as the best free identity theft protection because of its insurance coverage and trustworthiness. Aura came in second, and with its long 60-day money-back guarantee you can be sure you like it before you commit to paying.

All of Lifelock’s plans include a 30-day free trial. Be careful though, because it renews at the yearly rate for whichever plan you choose.